There are some exemptions allowed for RPGT. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual.

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

The Real Property Gains Tax Exemption Order 2018 PU.

. 1 Malaysian Citizens Permanent Residents Malaysian citizens andor permanent residents who sell their property within the first five years of acquiring it will be subject to RPGT. Rate 112010 - 31122011. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550 Youll pay the RPTG over the net chargeable gain.

Up to 31 December 2018 persons subject to tax under Part I of Schedule 5 enjoyed a zero-rate if they disposed of chargeable assets after a minimum holding period of five. 2 Foreigners Non-Citizens Foreigners will be charged a rate of 10 RPGT when they sell their property five years or more after purchasing it. Real Property Gains Tax RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

Chargeable Gain RM 800K RM 600K RM 50K RM150K Net Chargeable Gain RM 150K RM 15K 10 of Net Chargeable Gain RM 135K Real Property Gain Tax RM135K x 15 RM 2025K How to file for RPGT for individuals. RPGT stands for Real Property Gains Tax. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974.

Kementerian Kewangan Malaysia Putrajaya 30 Disember 2018. For detail of informstion on RPGT reference can be made to the RPGT Guidelines dated 13062018 or 18062013 whichever. It was suspended temporarily in 2008-2009 and reintroduced in 2010.

I am an individual selling a commercial property am I subject to GST. It is a positive move towards a higher home ownership rate among Malaysians in the future. The real property gains tax exemption no3 order 2018 which was gazetted on 31 december 2018 exempts any individual who is a citizen or permanent resident of malaysia from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company if the following.

This however does only apply to citizens and permanent residents. Among the measured announced there is one to me that stood out the most. The RPGT rate for a non-Malaysian citizen is 30 on the gain if the property acquired is less than five years old and 5 on the gain if the property acquired is more than five years old.

As such RPGT is only applicable to a seller. LAYANAN CUKAI KEUNTUNGAN HARTA TANAH CKHT BAGI. RPGT Exemptions tax relief Good news.

Vendorseller completes the CKHT 1A form Disposal of Real Property. A real property transaction subject to zero-rating means it is properly subject to RPGT but is subject to tax at the rate of zero if the requisite conditions are satisfied. For residential properties it is levied at a flat rate of 6 and can be paid in 2 instalments.

New Section 21B 1A RPGT Act 1976 Duty of the property buyer to withhold part of the consideration and remit it to Inland Revenue Board of Malaysia IRB. Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence. Fast forward 10 years later Malaysian citizens or permanent residents who disposes of his or her property within the first five years of acquiring it is subject to RPGT.

According to the RPGT Act there would be a minimal amount of 5 chargeable on the company when it disposes a property after 5 years. RPGT rate for disposal of chargeable asset under Part I Schedule 5 RPGT Act. Under the law when an individual would be subject to GST if.

Use this complete RPGT calculator to see how much youre about to be taxed if you sell your property in Malaysia. Download the official media release. 28 December 2018 The Real Property Gains Tax Exemption Order 2018 which was gazetted today exempts an individual from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company subject to the following conditions being fulfilled.

Selling a property less than or equal to 3 years of ownership results in a 30 tax on your net gains and reduces to 20 after the third year and 15 on the fourth year and finally 0 after 5 years of ownership. For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. It is the tax which is imposed on the gains when you dispose the property in Malaysia.

RPGT Payable Nett Chargeable Gain x RPGT Rate. If youre not a Malaysian citizen the rate is 30 if youre selling a property within 5 years or 5 if youve owned it for longer than that. Get the best home refinance package of Malaysia right now.

Check out our up-to-date Home Loan and Home Refinance comparison tools. It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them. For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil.

Disposal of assets to REITs and Property Trust Funds. If you owned the property for 12 years youll need to pay an RPGT of 5. The final sum is calculated based on the property type location and multiplied by a set of routes.

And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be. A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal of a chargeable asset other than shares from 1 January 2019 see Tax Alert No. Tax payable RPGT rate x net chargeable gain The RPGT rate imposed depends on the entity of the disposer whether a permanent resident individual citizen or company and the period of ownership of the property.

For Malaysian citizens and permanent residents - and also for companies - the rate is 30 if youre selling within 3 years 20 within 4 years and 15 within 5 years. While RPGT rate for other categories remained unchanged. Taxes incurred when acquiring and transacting real estate Stamp duty.

Effective Jan 1 2019 the RPGT has been increased for disposal of a property from the sixth year onwards. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Request A Free Quotation From Us Today Quotation For.

This is the latest Real Property Gain Tax RPGT table for the Year 2019. Disposal of assets in connection with securitisation of assets. A 3602018 of the Real Property Gains Tax Exemption Order 2018 A Malaysian citizen may apply for RPGT exemption in respect of the disposal of a property for a total consideration or market value whichever is higher of not more than RM20000000 in the sixth and subsequent years.

He owns more than 3 commercial properties.

Guide To Malaysian Real Property Gain Tax Rpgt

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

What Is Real Property Gains Tax The Malaysian Bar

Comprehensive Measures Needed For Property The Star

What We Need To Know About Rpgt

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

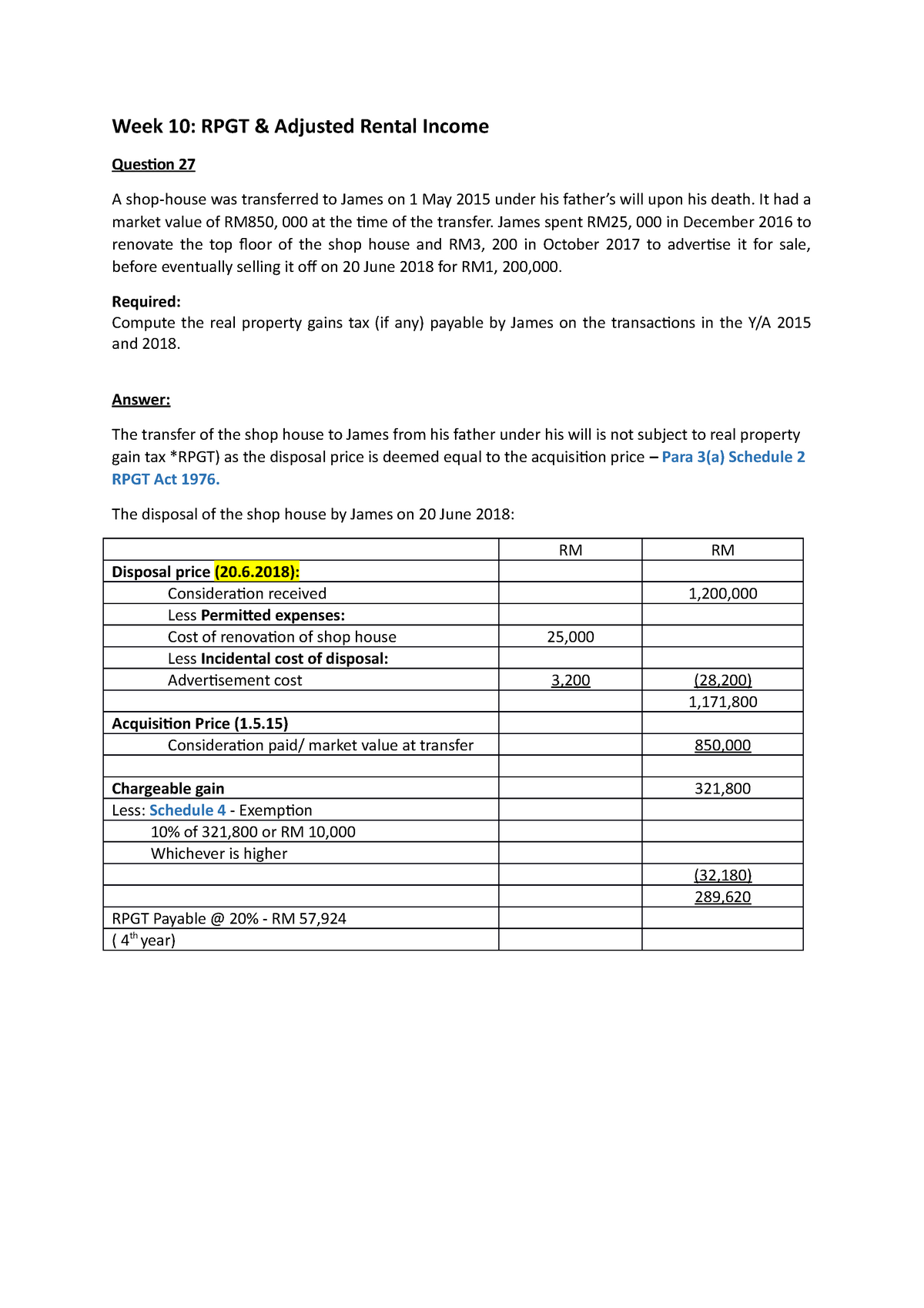

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Part 1 Acca Global

Key Changes In The Real Property Gain Tax Cheng Co Group

Key Changes In The Real Property Gain Tax Cheng Co Group

Financing And Leases Tax Treatment Acca Global

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

All You Need To Know About Real Property Gains Tax Rpgt

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

6 Steps To Calculate Your Rpgt Real Property Gains Tax

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia